Sudan delegation in China proposes increased oil investments

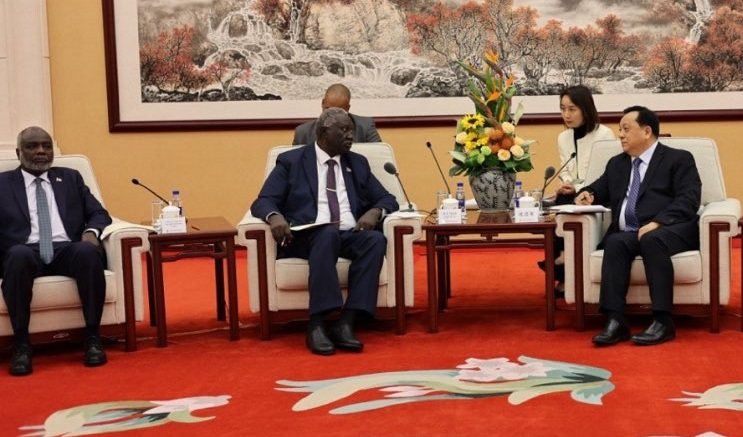

The Sudanese delegation meets with CNPC General Manager Dai Houliang, Beijing, November 3 (Photo: Malik Agar's account on X)

The Sudanese delegation currently visiting China met with the general manager of the China National Petroleum Corporation (CNPC) in Beijing on Friday. Finance Minister Jibril Ibrahim put forward a proposal to repay Sudan’s debts to China. Economist Haisam Fathi welcomed the visit, stressing the importance of Chinese investments to boost the Sudanese economy, ‘yet not during the war’.

The delegation, consisting of Defence Minister Lt Gen Yasin Ibrahim, Finance Minister Jibril Ibrahim, Dafallah El Haj, and undersecretary of the Ministry of Foreign Affairs, is headed by Malik Agar, vice president of the Sovereignty Council.

Agar said in a post on X on Saturday that the meeting with CNPC General Manager Dai Houliang “discussed the company’s 28 years of experience in Sudan and the establishment of a modern system for the oil industry in Sudan.

“We discussed several issues, including Chinese investments in Sudan, their expansion, and increasing oil production, in addition to investment in the field of renewable energy. We touched on the current investment opportunities available in the safe states and the company’s continued support for training Sudanese men and women in the field of oil and energy. And the opportunity for the company to work on rebuilding the country following the war.”

Finance Minister Ibrahim put forward a detailed proposal to repay Sudanese debts to China through increased investments in the oil sector. He also referred to the imminent signing of a new agreement between the governments of Sudan and South Sudan on the transfer of South Sudanese oil through Sudanese pipelines to Port Sudan, where it is shipped, “especially since it is one of the issues that the Chinese National Company pays attention to”.

The CNPC General Manager expressed “the desire of the Chinese government to continue the economic cooperation between the two countries and to stand by the Sudanese people”.

‘Instability’

Economist Haisam Fathi called the visit “a positive trend” and underscored the importance of Chinese investments to boost the economy. “However, the time is not right to invest in Sudan because of the insecurity and the instability of the Sudanese economic policies,” he told Radio Dabanga.

“In Sudan, the oil zones are located within war zones, while companies working in the field of investment, especially oil, cannot operate in insecure and unstable situations. Oil investments require large capital that cannot be risked in unsafe areas,” the economist explained.

Regarding the debts to China, Fathi said that “the amounts due to China, along with other oil-related arrears, have significantly grown since the secession of South Sudan in 2011”.

Regarding the project to establish a new port in Red Sea state with Chinese investments, Fathi said that Sudan does not need an extra passenger port as much as it needs ports to facilitate international trade. “Also, due to its geographical location, Sudan can provide port services to land-locked countries in the region,” he said, and stressed that the huge investment resources for projects in the Red Sea need to be explored.

Treasury

Last Tuesday, the Sudanese delegation met with Wang Yi, member of the Communist Party of China’s Political Bureau and Foreign Affairs Office Director, in Beijing.

Economist Patrick Heinisch, specialised in emerging markets in Africa, commented that the delegation planned to meet with representatives of the CNPC, the EXIM Bank China, as well as other Chinese companies engaged in petroleum, infrastructure, mining, and agriculture.

The Sudanese treasury is in dire need of increased income. Following the coup d’état by the Sudan Armed Forces (SAF) and the Rapid Support Forces (RSF) in October 2021, the Sudanese economy showed a ‘dismal performance’. In addition, the country lost $4,364 billion in aid pledged by the international community. The losses caused by the war between the SAF and RSF that erupted in mid-April, were estimated at $4 billion in June.

and then

and then