Experts question Central Bank of Sudan’s ability to control export revenues

Port Sudan harbour (Photo: Bertramz / Wikipedia)

The Central Bank of Sudan (CBoS) granted 250 Sudanese companies two months to supply reports of export revenues yesterday. The list includes several major companies. Two economic analysts spoke to Radio Dabanga about the new regulation and how it will impact the Sudanese economy.

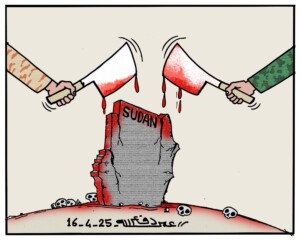

According to the statement, the two-month period to supply exports revenues to CBoS began on May 1. CBoS justified the policy because of “the country’s current economic circumstances.” Humanitarian conditions are rapidly deteriorating across Sudan, especially in the war zones, as most people’s resources have depleted significantly since April 15, 2023. On January 26, international organisations warned that every second person in Sudan needs aid.

CBoS warned that companies which fail to supply export revenues after the deadline will suffer a complete banking ban.

The announcement led commentators to question whether CBoS can enforce the regulation, especially on larger companies, as the government is the largest exporter and importer in Sudan and is currently represented by the military establishment.

Commentators also questioned whether these decisions will actually halt the deterioration of the value of the Sudanese pound or if they are merely decisions to ease criticism on the government, which is in severe economic crisis amid the ongoing war.

Limiting unnecessary imports

Banking expert and economic analyst Doctor Louay Abdelmonim, Head of the Department of International Relations at the International University of Africa, told Radio Dabanga that the problem of export revenues is not new.

“The issue reached headlines at the end of July 2021 when CBoS issued a comprehensive banking ban on 189 companies. It was more effective than the current decision because it included a ban on exports and imports until the export revenues were returned, along with a fine of 25 percent of the export revenues, or imprisonment until payment,” said Abdelmonim.

These regulations are “useless,” he said, because they encourage more violations. “In any case, these companies are often shell corporations which are used once and then discarded.”

The banking expert believed that it would have been better to take real action, after careful investigation, against the real partners and beneficiaries of the illegal export deals.

“The point of this regulation is to limit unnecessary imports that compete with local production, especially in wartime conditions. If CBoS succeeds in recovering export revenues, this will not be immediately reflected in the reduction of commodity prices in the markets, despite the reduction in the value of the dollar in the parallel market, until several months pass and the exchange rate stabilises.”

Security unrest, political instability, weak purchasing power because of inflation, the reluctance of remittances through official channels, and factories limiting large-scale production, have exacerbated the economic crisis. Therefore, “demand for the dollar actually decreases,” explained Abdelmonim.

“Because of the tendency of merchants automatically to reduce imports, the value of the US Dollar decreases on the parallel market without affecting the increase in the purchasing power of the local currency. This is due to the weakness of exports and limited supply of raw materials and manufactured goods. So, the prices of goods are raised accordingly to reduce the cost of production and sale.”

Abdelmonim said that the companies that failed to supply export revenues undoubtedly contributed to the rise in prices with this behaviour, but he added that it is not a major reason for the decline in the overall economy.

‘Deceiving public opinion’

An economic expert, who preferred to withhold his identity for security reasons, told Radio Dabanga that the CBoS Governor’s decision to ban banking is “fictitious” and is “deceiving public opinion.” He said that CBoS, which represents the state of Sudan, “is pretending that it is separated from the Islamists who are still in power.

“250 is not a large number,” he said, explaining that CBoS is targeting all actively exporting companies, including small exporters, of which there are many. “They export marginal goods, such as lentils from New Halfa to India through the same Dubai offices that are run by Islamists and their agents in Port Sudan.”

According to him, cargo ships accept papers and export contracts forged by export brokers in El Warqa in Dubai and others.

The heads of these companies are known by name, he said, explaining that they work under the protection of the Sudanese Armed Forces (SAF) and the Rapid Support Forces (RSF).

According to the economic expert, “the largest smuggler of Sudan’s exports is companies owned by the military.” In the year 2023, the volume of gold produced was 250 tons, according to the information provided by economic expert El Hadi Habani. “That year, the state’s income from gold revenue was only two tons,” he said, calling into question what happened to the rest of the gold that year.

Late April, the Sudanese Mineral Resources Company announced a gold export report in the first quarter of this year which generated revenue exceeding $428 million for CBoS, a statement which was met with scepticism by journalist and economic observer Hasan Mansour.

Abdelmonim agreed that there is no accurate information available about exports, stressing that it would not be available in wartime conditions. “Everything that has been leaked is merely estimates,” he said.

and then

and then